- #Ynab budgeting tips how to

- #Ynab budgeting tips mods

- #Ynab budgeting tips software

- #Ynab budgeting tips download

One of the things I know a lot of YNAB people do is to start a category household and write down the appliances and repairs and when they might happen. I do love being able to have a buffer of one month’s salary while I am working towards larger savings goals.Īlso for house maintenance 1% seems kind of low depending on how much your house costs. There is always an emergency that pops up.

I think the first thing you need to do is to realize that every month is different. This has helped me tremendously to keep track of everything. So I will write Mortgage $450(15th) and Verizon $65 (31st) as my title. One of the things that I have done is enter due dates on every item in my categories. And a year into YNAB we were able to get out of that cycle. We were in about about constant $5-6k constant debt when we started.

#Ynab budgeting tips mods

#Ynab budgeting tips download

You can also find the tutorials and help topics for YNAB 4, as well as download their previous apps on their Classic website.Īlso check out our wiki! Subreddit Guidelines Please wander over to some of the following links at YNAB's website: YNAB has a lot of really great support resources that you should probably check out. There is a YouTube playlist by YNAB which acts as a primer for nYNAB as well. Feel free to post your questions, budget strategies & advice.įor veteran users, learn more about the changes to the new rules in the Transition Guide. We welcome any posts here regarding YNAB.

#Ynab budgeting tips software

This subreddit is dedicated to discussion on the popular budget software You Need A Budget. NYNAB was last updated 10 November 2021 Welcome to /r/YNAB

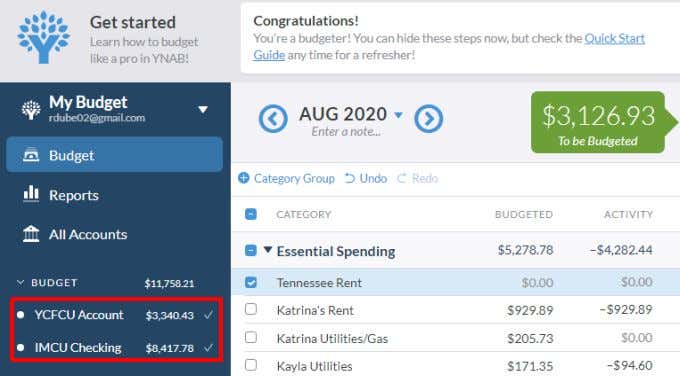

YNAB allows you to spread spending across different categories so if you need more money for essentials one month rather than entertainment you can do so and it will even things out for you.

#Ynab budgeting tips how to

Each section gives you advise and tips on how to organize your accounts effectively.

YNAB uses what it calls the 4 rules of cash flow - Stop Living Paycheck to Paycheck, Give Every Dollar A Job, Save For A Rainy Day and Roll With The Punches. However, You Need A Budget is named as such because its all about budgeting - something it does very well indeed and if you're having financial problems, you're advised to listen to what it says. You can of course, just ignore all this and open an account.

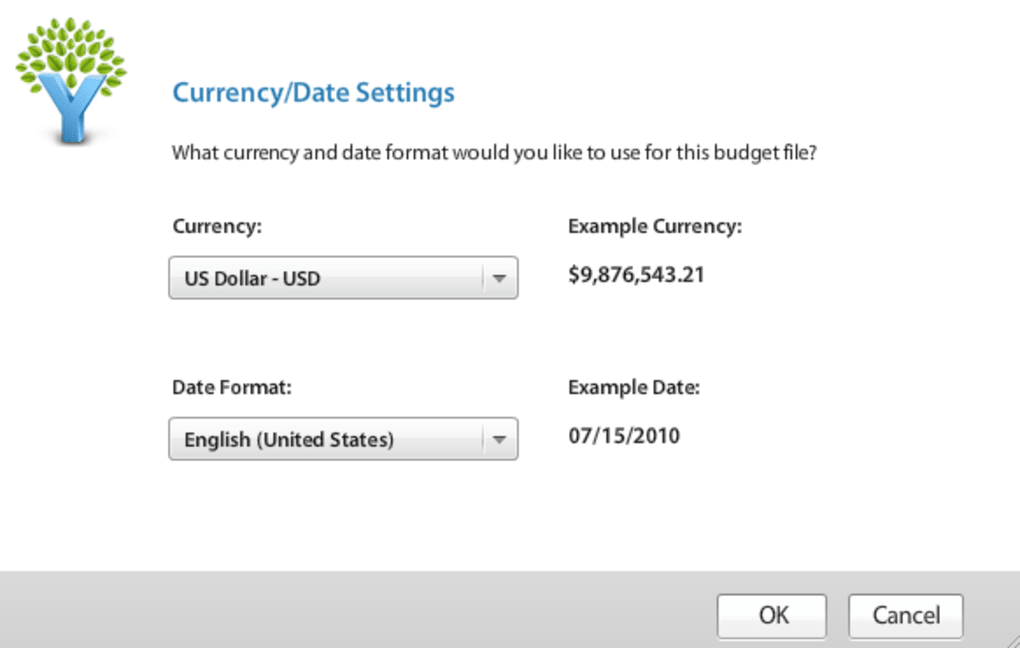

When you enter the main screen, YNAB acts as a kind of financial adviser, suggesting ways in which you should be managing your money. When opened for the first time, YNAB asks if you'd like to associate your downloaded bank statements with it or allow another application - such as Moneydance - to take care of that.

0 kommentar(er)

0 kommentar(er)